Crimson meat has misplaced share to chicken, comfort merchandise

Long run, pink meat has misplaced share to chicken and comfort merchandise, in keeping with a current AHDB market report. In line with the Defra Household Meals Survey, UK shoppers have lowered their mixed family consumption of beef, pigmeat and sheep meat by virtually 62% from 1980 to 2022, while hen meat gained share.

In 1980, complete pigmeat was probably the most consumed protein, adopted by beef, lamb, hen and fish. As client life and preferences have advanced over time, the share of proteins has shifted considerably.

Beef skilled probably the most reduce, significantly all through the 1990’s, coinciding with BSE and Foot and Mouth illness. Consumption shifted from 14.5kg per capita yearly in 1980, to five.0kg in 2022. Nonetheless, an growing quantity of meat fell beneath prepared meals, pies, spreads and canned merchandise. This makes up for a number of the beef shortfall, providing comfort and worth credentials.

In addition to utilizing completely different cuts of meat, each lowering consumption and buying and selling down by protein kind have been key methods for shoppers to save lots of on their grocery prices.

Since our client tracker analysis started in affiliation with YouGov in 2015, worth has been a key issue thought-about when selecting meat, with most up-to-date analysis indicating worth is an important issue for 78% of shoppers (AHDB/YouGov, Nov 2023).

Lamb consumption has been declining since 1980, when volumes matched hen. Rooster has since turn into the most affordable protein (Kantar), cuts corresponding to hen breast are reported by shoppers to be straightforward to cook dinner with, above that of pink meat merchandise (AHDB/YouGov, November 2023) *. The decline for pigmeat seems to be much less prevalent, however from 1980 to 2022, 8.2kg much less was consumed yearly per capita (Defra household meals survey, 2023).

Well being elements contribute considerably to those adjustments in consuming habits, with shoppers extra more likely to understand hen and fish as vital to a nutritious diet, much less fatty, and extra more likely to be eaten of their family than pink meat (AHDB/YouGov, July 2015 to November 2023).

By way of protein share out-of-home, an analogous story will be informed for retail. Crimson meats have seen gradual decline since 2001, with poultry gaining quantity (Defra out-of-home estimates, 2023).

Extra just lately, in-home consumption declines

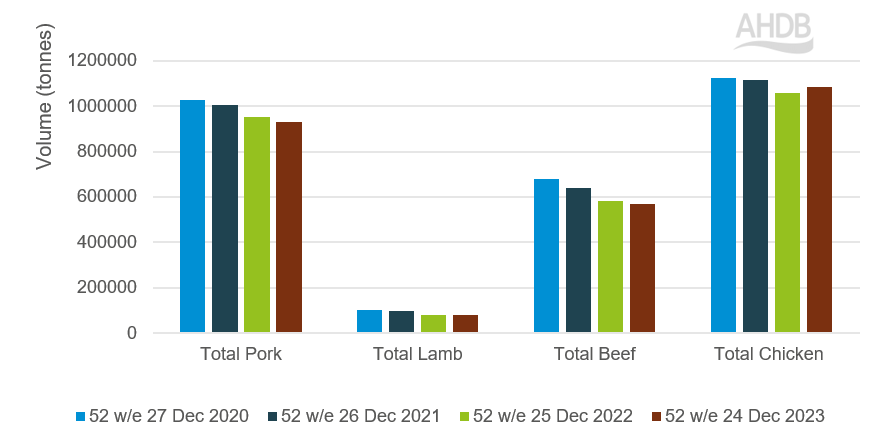

When taking a look at more moderen traits, retail knowledge reveals that complete volumes for beef, pork and lamb bought have all skilled declines during the last 4 years. Rooster noticed development of two.4% over the 52 w/e 24 December 2023, although 2022 ranges had been decrease than the earlier two years (Kantar).

Retail quantity purchased over 52 w/e interval

Supply: Kantar, volumes bought 52 w/e 24 December 2023

Analysis carried out by AHDB with YouGov signifies that meat reducers have reduce as a consequence of animal welfare, the atmosphere, and well being causes, however a dominating motive for reducing again on meat consumption is value (AHDB/YouGov, November 2023).

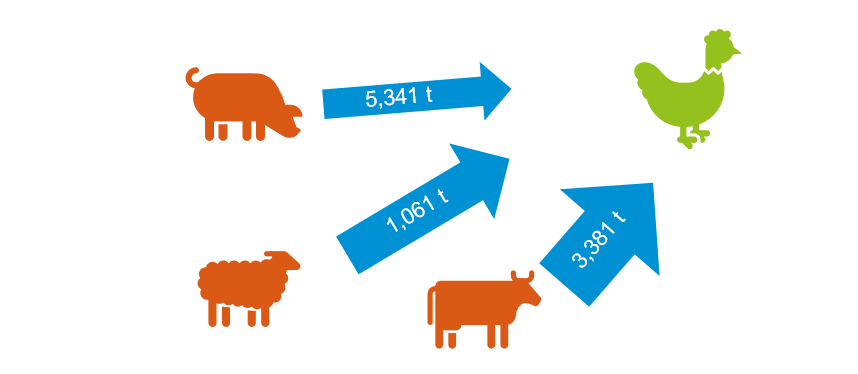

Over 2023, switching knowledge explains that there have been substantial actions in the direction of hen, negatively impacting all different proteins (52 w/e 24 December 2023)**. Rooster will be thought-about by shoppers as probably the most versatile meat (AHDB/YouGov, November 2023), together with interesting to those that are worth delicate, with common costs paid during the last two years being constantly round £1/kg lower than pork (Kantar).

Complete quantity switching between proteins

Supply: Kantar, Switching precise quantity (000kg) 52w/e 24 December 2023

Measurement of visuals provides a sign of the weighting and course of quantity actions between proteins

Crimson meat good points out of dwelling recognition

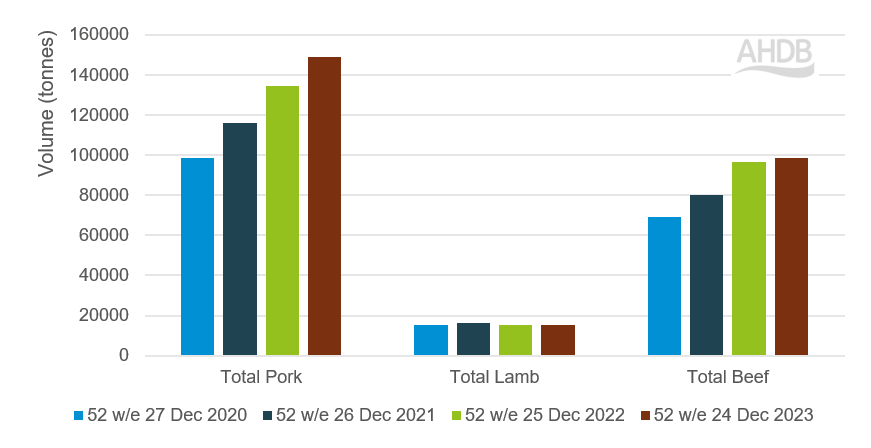

Contrasting the drop of demand in retail, pink meat efficiency within the out-of-home market has seen elevated demand, nevertheless it has not but recovered to pre-covid ranges of consumption.

Foodservice quantity purchased, in contrast over 52 w/e intervals

Supply: Kantar, Foodservice – AHDB estimates of Kantar OOH

Current traits point out that buyers are on the lookout for these out-of-home meal events, however to realize this inside of their funds are buying and selling down channel to realize this. Nonetheless, costlier meal events are nonetheless being indulged in, simply at a decrease frequency. Consequently, volumes of beef, lamb and pork have all seen year-on-year will increase (52 w/e 24 December 2023, Kantar Out of House).

Alternatives for pink meat

Following numerous challenges, buyers are nonetheless reported to be battling their family finance. With grocery worth inflation now at its lowest since March 2022, will we begin to see larger uplift in pink meat gross sales?

The AHDB 2024 Agri market outlooks predicted a 1% home improve in quantity for beef however declines of -2% for each lamb and pork volumes.

The primary quarter of 2024 has skilled agency demand for lamb, and excessive costs at farmgate degree. With upcoming non secular festivals, lamb is anticipated to be the protein of alternative.

Whereas worth is clearly an vital influencing issue at current, we anticipate that reputational subjects round welfare, atmosphere and well being will develop in significance to shoppers as client confidence returns. Consequently, you will need to deal with these reputational areas in order to affect buy intent for pink meat merchandise, offering reassurance and confidence for buyers buying pink meat.