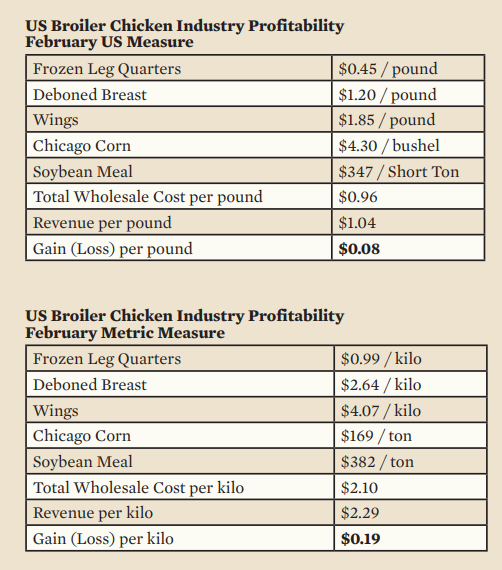

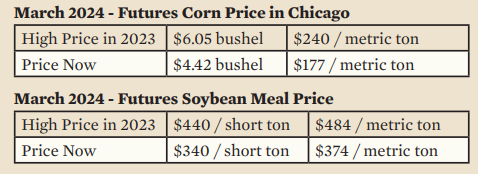

Corn and soybean meal costs are at the moment in a ferocious bear market. Ample world provides mixed with sluggish progress in demand is leading to a windfall for the poultry business. It’s definitely not excellent news for grain producers, however it’s nice information for the poultry business.

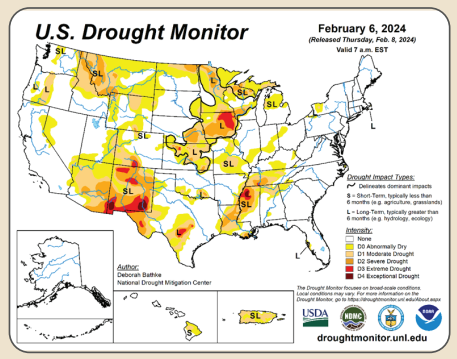

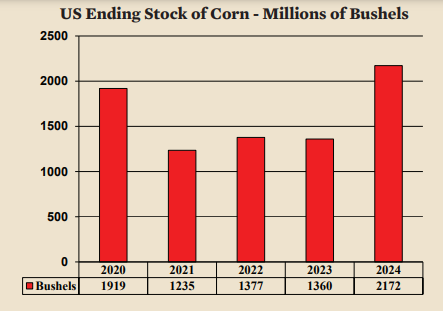

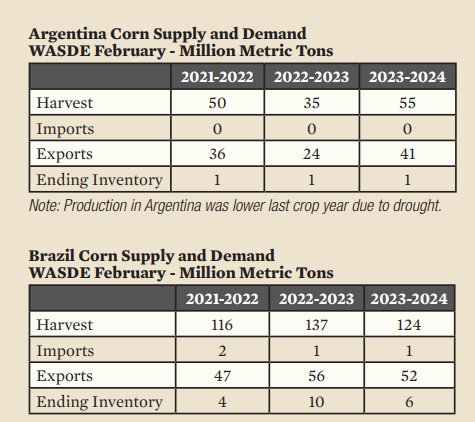

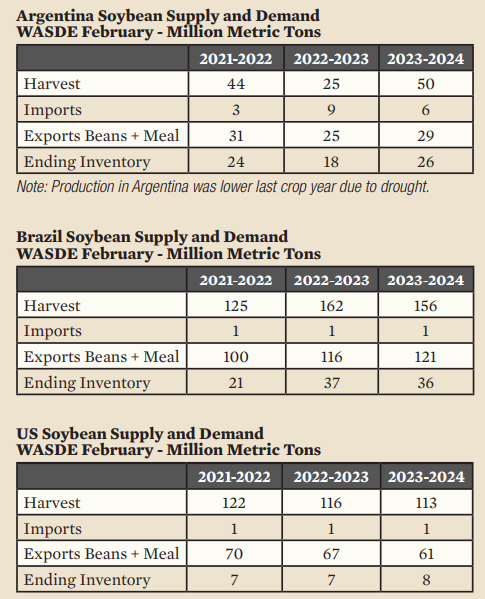

After all, the low-price celebration could be ruined by a drought in a number of of the necessary rising areas. Argentina had a extreme drought final yr which affected manufacturing, however Brazil made up for the shortfall. This yr, Argentina had higher however not excellent climate whereas Brazil had worse climate. The mixed whole manufacturing of the 2 international locations continues to develop, up 6 MMT final crop yr and up 7 MMT this crop yr. The US flirted with a drought final yr however managed a superb harvest. It’s too early to inform about this yr, however the drought monitor beneath exhibits some components of the Corn Belt in numerous phases of drought.

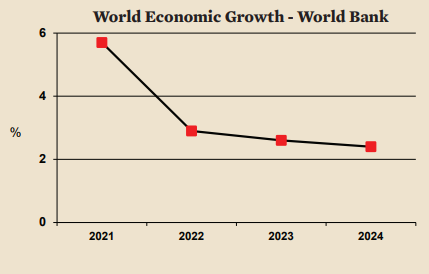

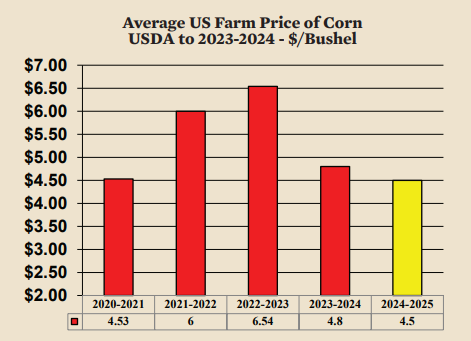

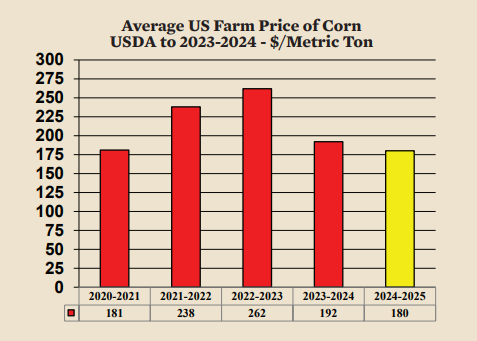

Is that this the underside of the bear market? It may very well be, nonetheless grain costs are tempered by a slow-growing world economic system and elevated grain provide. The underside of the bear market won’t come till crop yr 2024-2025.

Corn

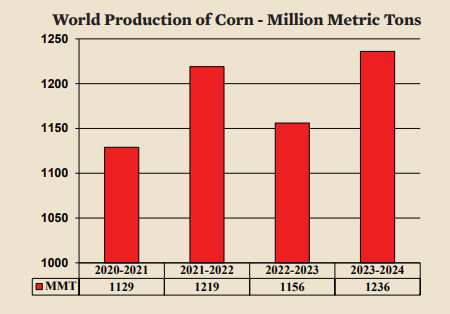

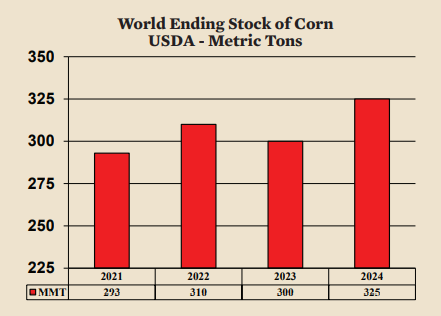

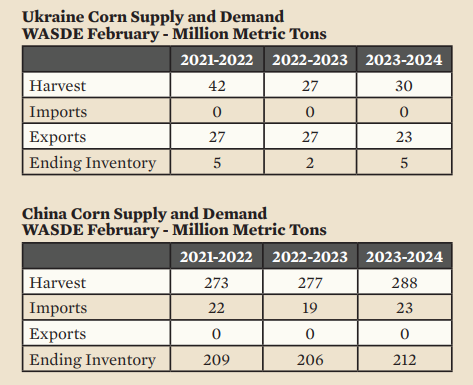

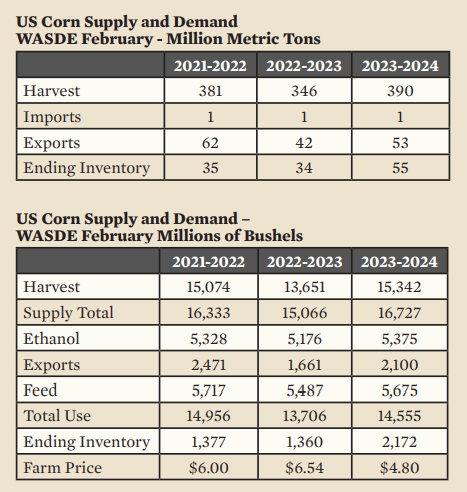

World corn manufacturing is predicted to rise this crop yr (2023- 2024) on account of will increase within the US, China, and Argentina. With larger manufacturing, and better ending stock, costs could be anticipated to common lower than final crop yr. The common worth for final crop yr was $6.54 per bushel ($262 per metric ton). The common is more likely to be lower than $5.00 ($200 per metric ton) this crop yr and may very well be even decrease subsequent crop yr if the bear market continues.

Soybeans

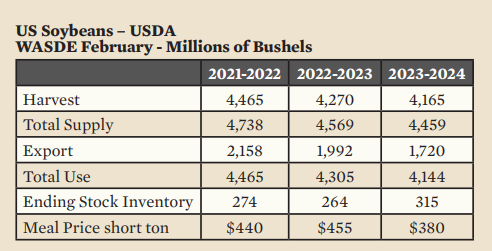

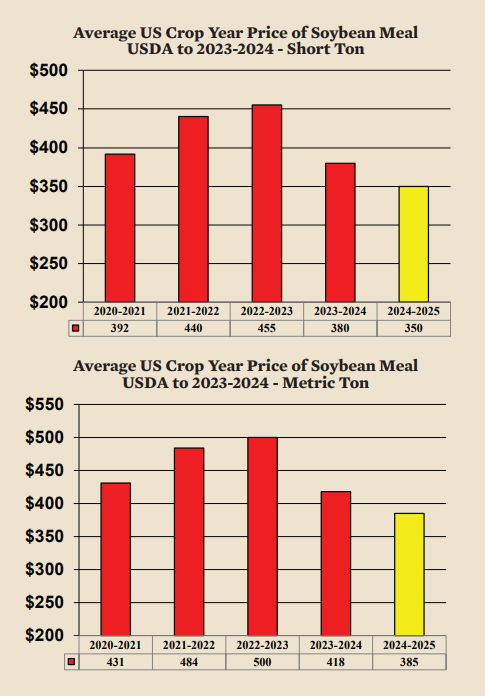

Manufacturing in South America elevated 10 MMT final crop yr regardless of a extreme drought in Argentina. The big capability of Brazil to extend soybean manufacturing negated the impact of the drought in Argentina. This crop yr will see a fair bigger improve in South America with a lot larger manufacturing in Argentina and barely decrease manufacturing in Brazil. Manufacturing of soybeans in South America (Argentina, Brazil and Paraguay) is now twice as excessive as manufacturing within the US (221 MMT versus 113 MMT). Extra importantly, exports of beans and meal mixed are 2.5 occasions as excessive as exports from the US. Consequently, crucial clues as to what’s going to occur to the long run provide of soybeans and SBM now come from South America, not the US. Rising manufacturing in South America means that soybean meal will common not more than $380 on this present crop yr ($418 per metric ton) because the USDA suggests and will drop additional subsequent crop yr.

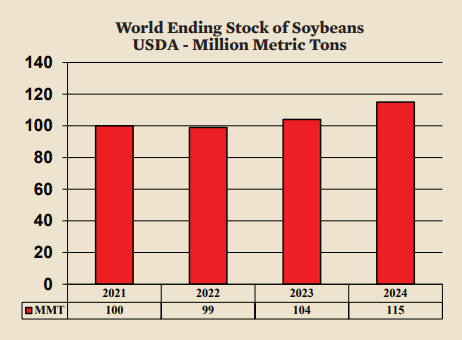

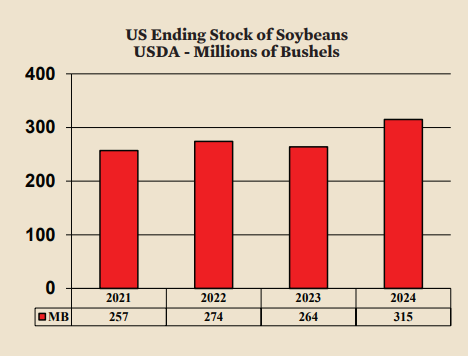

On account of a lot larger manufacturing in Argentina, world ending shares are anticipated to be larger this crop yr. Subsequently, the present decrease costs for soybeans and soybean meal could be anticipated to persist.

Rooster Business

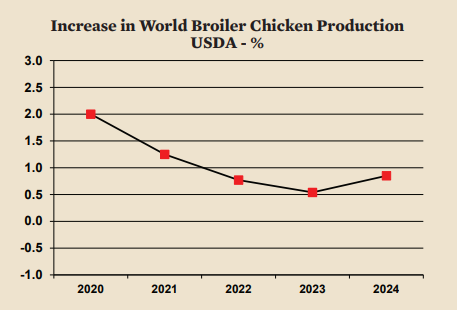

The world hen business expanded simply 0.5% final yr. Gradual progress was on account of a slowing world economic system and comparatively excessive grain costs along with some losses on account of avian influenza. Regardless of decrease grain costs, world manufacturing progress this yr is once more anticipated to be low; solely 0.85%. With comparatively few chickens and depressed grain costs, 2024 ought to be an glorious yr for the world poultry business.

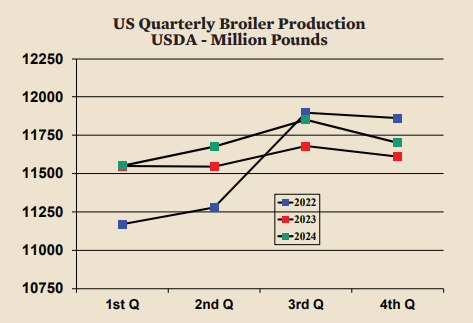

US manufacturing accelerated in 2022 resulting in a pointy decline in wholesale costs. Low costs led to a lower in year-to-year manufacturing in 2023. For all of 2023, proportion progress was solely 0.4%. For 2024, the USDA predicts that progress will speed up to almost one %.

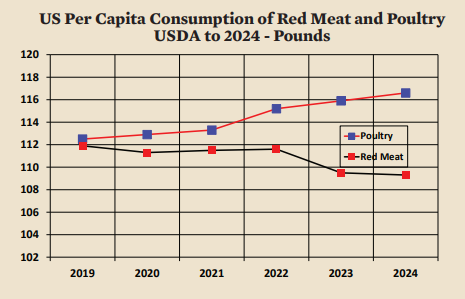

Poultry per capita consumption within the US has been rising just lately whereas purple meat per capita declined. Between 2022 and 2024, purple meat per capita consumption fell by two kilos (1 kilo) whereas poultry consumption rose by one pound (1/2 kilo). In 2024 the meat business is more likely to attain the underside of the beef cycle and manufacturing may improve in 2025 and past. It’s fascinating to notice that whole meat consumption elevated just one.5 kilos (0.7 kilo) from 2019 to 2024.

The long run could also be a zero-sum recreation the place whole purple meat and poultry consumption is comparatively steady. In a zero-sum recreation, the rise in consumption of 1 meat can be matched by a decline in one other meat. If that’s true, it’s doubtless that whole purple meat consumption per capita will proceed to say no slowly.

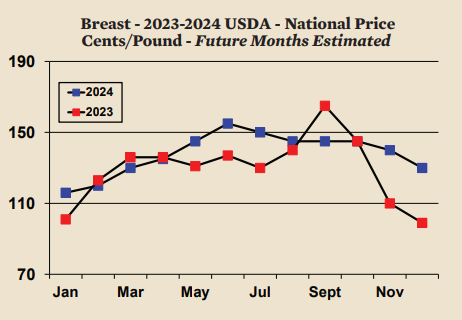

Deboned Breast

Deboned breast meat costs fell in the previous few months of final yr however recuperated within the first two months of this yr. Total, costs this yr are more likely to be barely larger than final yr. Decreased provides of purple meat this yr and a comparatively strong US economic system ought to assist assist the worth of deboned breast.

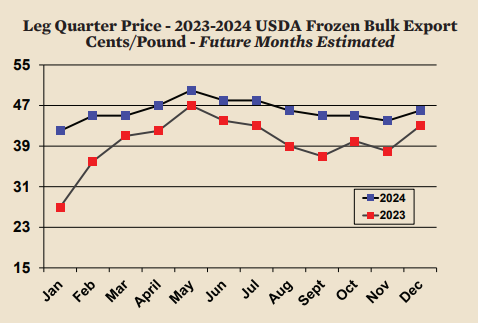

Frozen Leg Quarters for Export

Robust worldwide demand for frozen leg quarters despatched costs larger final yr. Costs could be anticipated to proceed to extend in 2024 to a excessive of roughly 50 cents per pound ($1.10 per kilo) baring commerce points that limit commerce.

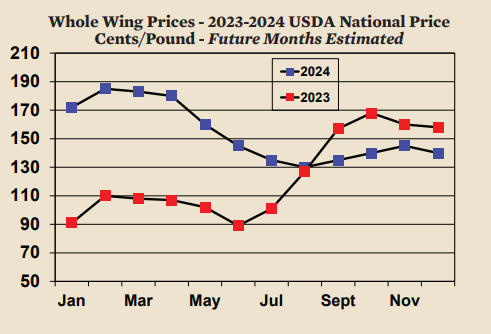

Wings

Wing costs are off to a outstanding begin this yr. The value is 75 cents per pound ($1.65 per kilo) larger than final yr at this time. Wings have soared excessive above that of deboned breast, not a sustainable scenario. Wings could be anticipated to fall if deboned breast costs stay decrease than wings.

Because of the agency demand for hen and low worth of grain, hen manufacturing within the US is at the moment worthwhile and is probably going to proceed to be worthwhile all year long.