FCC addresses distinctive points three sub-sectors

The poultry sector has finished a exceptional job in addressing the challenges which have come from outbreaks of avian influenza lately, writes Graeme Crosbie of Farm Credit score Canada (FCC). Though the virus continues to be current, the sector can hopefully restrict the effort and time required to reduce illness unfold and slightly focus efforts solely on manufacturing to satisfy evolving demand for hen, eggs, and turkey. We tackle the distinctive points of every of those three subsectors under.

Weaker broiler costs pushed by decrease feed prices

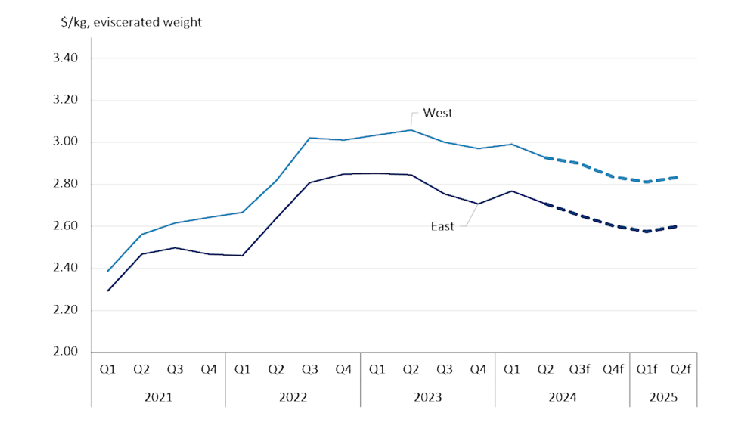

Broiler costs peaked in 2023 and have slowly retreated since. We’re forecasting this decline to proceed within the second half of 2024 earlier than stabilizing in spring 2025 (Determine 1).

Determine 1: Broiler costs, noticed and forecast

Sources: Statistics Canada, FCC Economics

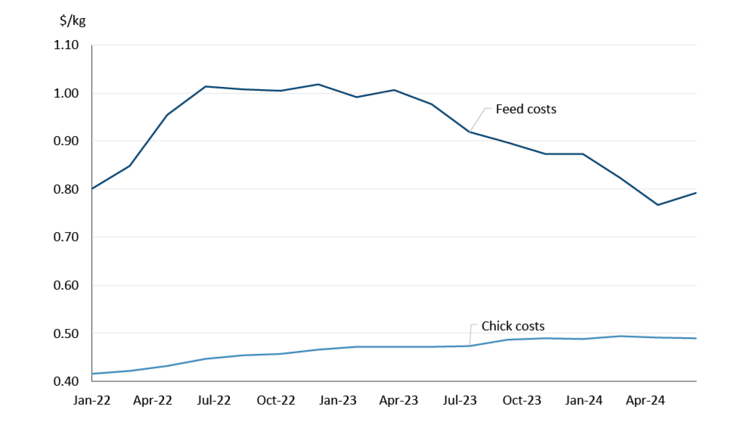

The decline in farm gate costs displays easing feed prices. In Ontario, the feed value part of the farm gate minimal stay value rose to over $1.00/kg in the summertime of 2022 however started falling within the second half of 2023 according to decrease grain and oilseed costs. Feed costs are down -22% relative to their peak within the A-180 quota interval (December 2022 – February 2023). Chick prices, nevertheless, have been persistently rising during the last two and a half years, partially a results of the provision scarcity attributable to the avian flu (Determine 2).

Determine 2: Ontario feed and chick prices by quota interval

Supply: Rooster Farmers of Ontario

Broiler manufacturing progress amid excessive inventories, imports

Contemplating the challenges caused by avian flu, whole broiler manufacturing in 2023 was surprisingly robust (3.3% progress). For 2024, the USDA is forecasting manufacturing progress to sluggish to 1.7% which, if realized, could be the bottom price of progress since 2014 (excluding 2020 and the onset of the pandemic).

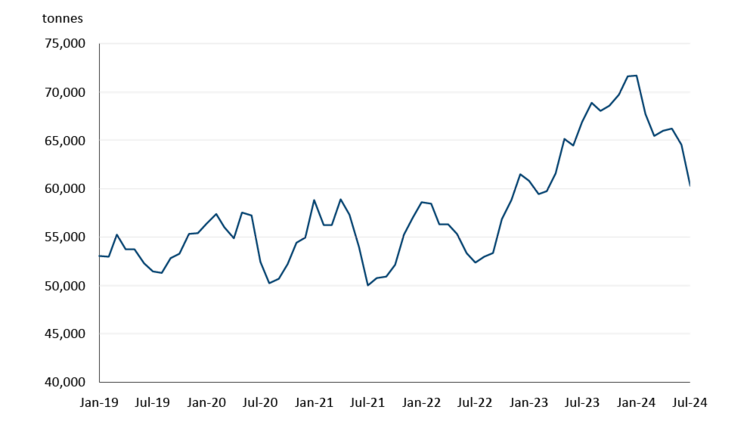

The Rooster Farmers of Ontario 2023 Annual Report famous that “record-high frozen inventories resulted in conservative [quota] allocations for the primary 4 months of 2024.” With decrease manufacturing at first of the yr, demand was met with hen inventories which have been drawn down -16% from January to July (Determine 3). Shares of frozen hen have been traditionally excessive heading into 2024 and are often drawn down within the spring and summer time months, although notably final summer time the alternative occurred and stock ranges surged. A return to extra historic ranges of frozen shares bodes properly for manufacturing within the latter half of the yr and into 2025.

Determine 3: Shares of frozen hen down -16% since January

Supply: Statistics Canada

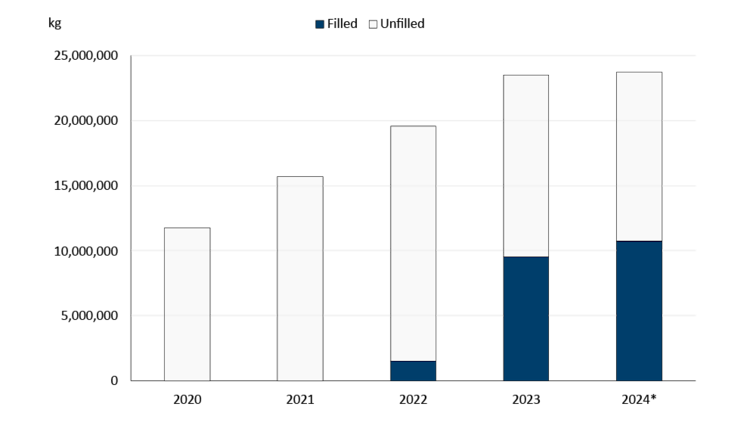

Uncertainty round import volumes issues a fantastic deal. Varied commerce agreements enable for a sure quantity of hen to be imported tariff-free (i.e., the negotiated restrict) although in actuality it isn’t at all times the case that the imports happen. For instance, in 2023 and below Complete and Progressive Trans-Pacific Partnership (CPTPP), solely 40% of the negotiated restrict was really imported. Nevertheless, to this point in 2024, imports have amounted to 45% of the negotiated restrict with half of the yr remaining (Determine 4). The surge in imports below CPTPP is basically the results of imports from Chile who joined the settlement in February 2023. Commerce information exhibits Chile is now the third largest supply of imported hen behind the US and Brazil.

Determine 4: CPTPP imports of hen and hen merchandise, 2020 to 2024

*2024 worth is year-to-date by to and together with June.

Supply: World Affairs Canada

Negotiated limits of hen imports at the moment are successfully capped. As you’ll be able to see in Determine 4, the negotiated restrict elevated by 3.9 million kgs annually for the reason that CPTPP’s implementation however in 2024 the rise was solely 0.2 million kgs as the accelerated phase-in interval concluded. Negotiated restrict will increase will probably be capped at 1% (roughly 0.2 million kgs) for every of the subsequent 12 years. It must be famous that in 2023, hen imports below CPTPP amounted to roughly 0.7% of whole manufacturing for the yr.

Total demand for hen is up to this point in 2024 however under potential. Tighter family budgets have restricted shopper purchases of hen relative to preferences. June was the primary month since 2022 that hen value will increase have been decrease than beef and pork costs; ought to this pattern proceed, it is going to be additional supportive of demand.

Egg manufacturing reaching new file stage

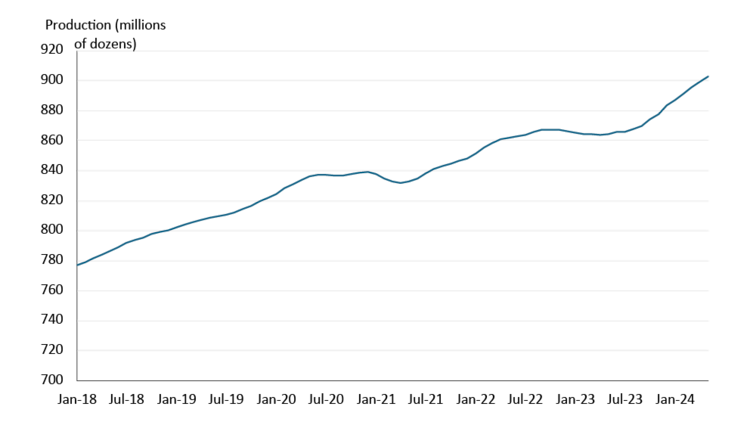

The farm gate value of eggs elevated in February and is projected to stay secure within the latter half of 2024. Egg manufacturing has rebounded from decrease manufacturing ranges in 2023 that corresponded with the avian flu outbreak: between June 2023 and Might 2024, 903 million dozen eggs have been produced, the largest 12-month tally on file (Determine 5). Complete manufacturing prices have edged barely decrease to this point in 2024 however nonetheless stay traditionally excessive.

Determine 5: Egg manufacturing again on observe, reaching file highs

Sum of earlier 12 months manufacturing

Supply: Statistics Canada, FCC Economics

The U.S. has taken full benefit of further tariff-free entry for eggs and egg merchandise (e.g., shell eggs, egg powder, and so forth.) for the reason that implementation of the Canada-United States-Mexico Settlement (CUSMA). The negotiated quantity of egg and egg merchandise allowed to enter the nation has been crammed annually; certainly, we’re solely midway by 2024 and the negotiated restrict of eggs and egg merchandise has already been crammed. Put one other method, there will probably be no additional tariff-free imports of egg and egg merchandise from the U.S. and Mexico for the rest of 2024.

Turkey inventories, manufacturing larger – however so is demand

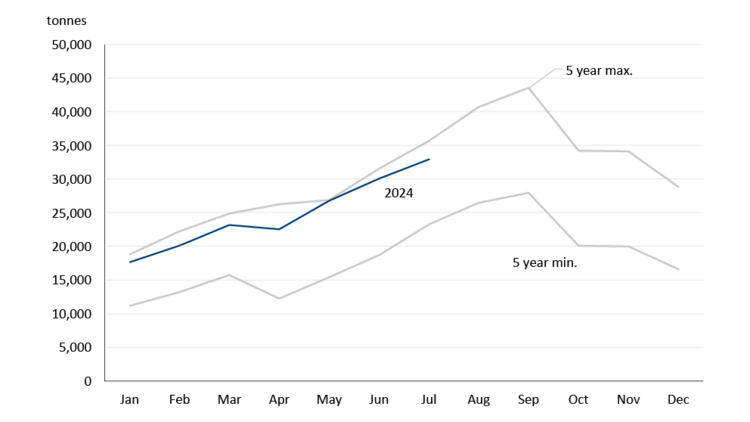

Turkey inventories historically peak in September within the lead-up to the North American vacation season earlier than plummeting to seasonal lows in January. Up to now in 2024, frozen turkey inventories are trending near the month-to-month most ranges seen during the last 5 years (Determine 6).

Determine 6. Turkey frozen shares near latest historic highs

Sources: Statistics Canada, FCC Economics

At first look that is considerably stunning, on condition that turkey manufacturing fell yearly between 2016 and 2022 (from 183,000 mt to 150,000 mt). Shifts in shopper preferences have led to a weaker demand for turkey merchandise lately. Nevertheless, final yr was the primary yr since 2016 there was a rise in turkey manufacturing (a 6.1% enhance). Demand performed a job right here: 2023 was the primary time in practically a decade that per capita consumption of turkey elevated.

As is the case with broiler costs, turkey farm gate costs elevated between 2021 and early 2023 earlier than falling barely within the latter half of 2023. Costs declined much more in early 2024 and are forecast to be barely decrease within the second half of 2024 earlier than stabilizing within the first half of 2025.

Backside line

Decrease grain and oilseed costs have been a welcome aid to livestock producers, together with these within the poultry sector. Broiler manufacturing progress could also be decrease this yr however producer margins on a per unit foundation stay wholesome: as of quota interval A-187, the margin part of the farm gate value was up to date to replicate elevated labour, capital, and working bills. Egg manufacturing is at file highs, whereas turkey manufacturing could also be turning the nook after a stretch of decrease demand and manufacturing. Decrease meals inflation ought to assist demand for poultry merchandise, and the long-term fundamentals for the sector are sound.

Used with permission from FCC