Commerce is getting extra aggressive

In accordance with the most recent animal protein report by Rabobank, the outlook for international poultry markets is additional enhancing, pushed by accelerated development in poultry meat consumption, starting from 1.5% to 2%, and disciplined provide development in lots of markets. After 4 years of extremely disruptive circumstances, international poultry markets are shifting towards extra “regular” market circumstances. International commerce is anticipated to change into extra aggressive than up to now two years on account of shifts in commerce flows.

International poultry costs stay sturdy

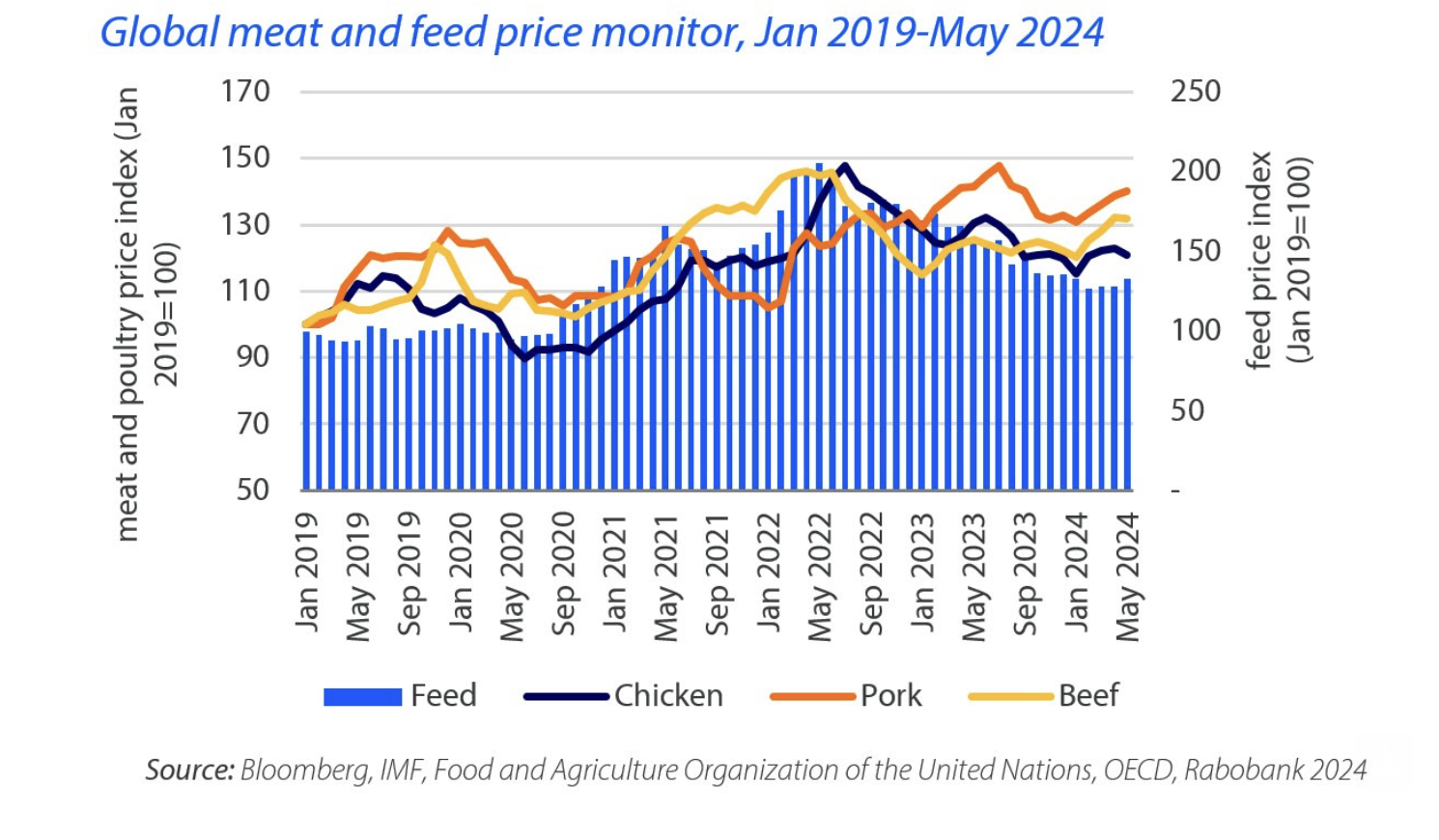

Regardless of a 2% improve in international hen costs, hen stays a competitively priced protein possibility, as costs of pork and beef have elevated by 4% and 5%, respectively. Nevertheless, operations stay a essential space of focus for producers.

Feed costs have hit their lowest level after two years of decline, and have elevated for the primary time in two years (+1%) on account of weaker-than-expected harvest predictions in Brazil, North America, and Europe. In accordance with Nan-Dirk Mulder, Senior Analyst – Animal Protein at Rabobank, sturdy emphasis on procuring feed elements and optimising feed formulations shall be needed, significantly contemplating the chance of a La Niña season on international crop harvests, which might have an effect on main grain producers.

Sturdy native market circumstances are driving international development

“Most of this international development has been pushed by sturdy native market circumstances relatively than commerce. That is significantly true for rising markets in Southeast and South Asia, Africa, and Latin America,” stated Mulder. “Decrease feed costs have made hen extra reasonably priced, supporting demand restoration.”

The EU and the US are performing properly this 12 months, with comparatively sturdy demand, managed manufacturing development, and rising costs. The principle exceptions to this comparatively sturdy market atmosphere are China and Japan, the place the business has skilled overly formidable development charges above 3% this 12 months, which negatively impacted native profitability. Brazil had additionally been heading towards an oversupply, however current manufacturing cuts are anticipated to assist steadiness the markets.

Chia’s decrease import volumes will shake up international commerce, growing competitors

In Q1 2024, international poultry commerce dropped by 5% YOY, with a 40% discount in Chinese language imports being a notable trigger.

“The weak and oversupplied home hen market in China was the first driver behind this vital drop in commerce. Key exporters to China – Brazil, the US, and Russia – have all felt this decline,” famous Mulder. “We anticipate that these nations will search different markets to offset the affect of decreased Chinese language commerce, significantly affecting hen toes and leg markets.”

Moreover, the brand new EU import quota for Ukraine will affect international commerce in breast meat and entire hen, significantly as Ukraine will more and more search for different markets.

Rising considerations in Southern Hemisphere on account of avian influenza

Avian influenza stays a essential concern for the poultry business globally, requiring an ongoing sturdy concentrate on biosecurity practices to mitigate dangers. Dangers are at the moment shifting again into the Southern Hemisphere, with current outbreaks in Australia and ongoing circumstances in South Africa and Latin America. These outbreaks might result in sudden shifts in commerce flows, each for imports and exports.