Livestock analyst Jim Wyckoff experiences on international protein information

Weekly USDA US beef, pork export gross sales

Beef: Web gross sales of 10,100 MT for 2024 have been down 35 p.c from the earlier week and 34 p.c from the prior 4-week common. Will increase have been primarily for China (2,100 MT, together with decreases of 100 MT), Japan (1,700 MT, together with decreases of 200 MT), Mexico (1,600 MT), South Korea (1,400 MT, together with decreases of 300 MT), and Canada (1,200 MT). Whole internet gross sales of 100 MT for 2025 have been for Japan. Exports of 12,500 MT have been down 24 p.c from the earlier week and 14 p.c from the prior 4-week common. The locations have been primarily to South Korea (3,100 MT), Japan (2,600 MT), China (1,500 MT), Mexico (1,300 MT), and Taiwan (1,100 MT).

Pork: Web gross sales of 28,000 MT for 2024 have been down 3 p.c from the earlier week and eight p.c from the prior 4-week common. Will increase have been primarily for Mexico (13,000 MT, together with decreases of 300 MT), Canada (3,300 MT, together with decreases of 700 MT), China (2,700 MT), South Korea (2,500 MT, together with decreases of 500 MT), and Colombia (1,900 MT, together with decreases of 100 MT). Exports of 27,900 MT have been down 11 p.c from the earlier week and three p.c from the prior 4-week common. The locations have been primarily to Mexico (11,800 MT), Japan (3,600 MT), China (3,000 MT), South Korea (2,000 MT), and Colombia (1,900 MT).

China to stabilize beef, dairy sectors to help farmers

China’s agriculture ministry stated it might stabilize beef and dairy manufacturing, shore up consumption and help farmers amid falling costs. The ministry’s plan referred to as for the promotion of beef and milk consumption and help for farmers by providing mortgage extensions and reducing feed prices. The plan stated localities can be required to speed up the growth of herds, whereas selling larger high quality cows. Vouchers might be used to push extra milk consumption. The ministry referred to as for prevention and management of illness in cow herds and stated extra focused help insurance policies would finally be rolled out for agriculture and different sectors. China’s beef costs have fallen to the bottom degree in 5 years.

USDA Hogs & Pigs report anticipated to point out marginally bigger US hog herd

Analysts count on USDA’s Hogs & Pigs Report this afternoon to point out the U.S. hog herd grew 0.2% from year-ago to 76.285 million head as of Sept. 1. Market hog inventories are anticipated to be up 0.4%, whereas the breeding herd is anticipated to be down 2.1%. Analysts count on USDA to report a 0.9% smaller summer time pig crop regardless of ongoing document litter sizes, as summer time farrowings seemingly declined 1.4%. Wanting ahead, analysts count on farmers to farrow 0.4% fewer sows throughout fall however 0.1% extra this winter. As all the time, revisions to previous information might be key.

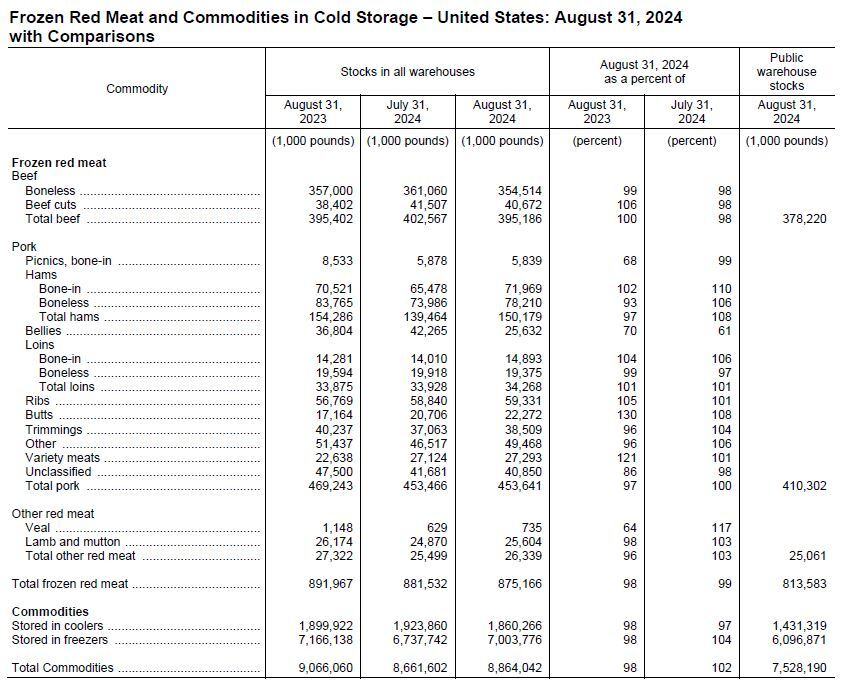

USDA Chilly Storage Report reveals pork and beef down from year-ago

Whole crimson meat provides in freezers have been down 1 p.c from the earlier month and down 2 p.c from final 12 months.

Whole kilos of beef in freezers have been down 2 p.c from the earlier month and down barely from final 12 months.

Frozen pork provides have been up barely from the earlier month however down 3 p.c from final 12 months. Shares of pork bellies have been down 39 p.c from final month and down 30 p.c from final 12 months.

The five-year common is a 5.1-million-lb. improve in beef shares and a 5.3-million-lb. rise in pork shares in the course of the month.

Colombia totally reopens to US beef after lifting H5N1 ban

USDA’s Meals Security and Inspection Service (FSIS) stated U.S. beef and beef merchandise have been not ineligible for export to Colombia as of Sept. 23. The U.S. Meat Export Federation (USMEF) confirmed that Colombia has lifted its ban on U.S. beef from states affected by H5N1 in dairy cows, restoring entry to beef from 13 states. USMEF President Dan Halstrom expressed gratitude to USDA groups and Colombian importers, emphasizing the numerous affect the ban had on commerce, with exports dropping to lower than $850,000 in July. Previous to the ban, U.S. beef exports to Colombia averaged $3 million per thirty days.

Panel recommends USDA streamline meat plant inspections with new know-how

The Nationwide Advisory Committee on Meat and Poultry Inspections (NACMPI) urged USDA to undertake new applied sciences to streamline inspections in meat and poultry vegetation. Suggestions embrace offering inspectors with government-issued telephones and tablets to doc findings, permitting video chat for communication, and utilizing know-how that converts voice or handwriting into digital textual content. These measures intention to cut back inspectors’ workloads and pace up inspections. Whereas some adjustments, similar to distant inspections, might scale back delays and prices for firms, others, like video recording inside vegetation, might elevate aggressive issues.

First US chook flu outbreak in 9 weeks

Extremely pathogenic avian influenza was confirmed at a turkey farm with 62,800 turkeys in Merced County, California, the primary U.S. outbreak of chook flu in a industrial flock since July 19.

Impartial USDA cattle-on-feed report

USDA final Friday estimated there have been 11.198 million head of cattle in massive US feedlots (1,000-plus head) as of Sept. 1, up 71,000 head (0.6%) from final 12 months. August placements declined 1.4%, whereas marketings fell 3.6% from year-ago ranges. The entire classes have been near the typical pre-report estimates.

USDA awards $35 million to spice up US meat and poultry processing capability throughout 12 states

USDA Secretary Tom Vilsack introduced $35 million in grants to fifteen impartial meat processors in 12 states as a part of the Meat and Poultry Processing Enlargement Program (MPPEP). The funding goals to extend processing capability, spur competitors, and create rural jobs. This marks the ultimate funding from the American Rescue Plan’s MPPEP, bringing whole awards to over $325 million since 2022. The initiative seeks to strengthen the meals provide chain and supply farmers extra market alternatives.

USDA goals to finalize US livestock guidelines by year-end, eyes cattle value rule in 2025

USDA Secretary Tom Vilsack introduced plans to finalize two livestock-related guidelines by the tip of 2024, aligning with the Biden administration’s regulatory objectives. The foundations handle truthful livestock markets and poultry grower cost methods. In the meantime, a pre-rule on cattle value discovery is anticipated to maneuver ahead in early 2025. Nevertheless, these efforts might face uncertainty if Donald Trump wins the 2024 election, probably altering or halting rulemakings initiated by the Biden administration.

EWG sues Tyson Meals for alleged false claims on environmental affect and sustainability

The Environmental Working Group (EWG) filed a lawsuit towards Tyson Meals, Inc., accusing the corporate of constructing false and deceptive claims about its environmental affect and sustainability efforts. The lawsuit, filed within the Superior Court docket of the District of Columbia, targets two fundamental claims made by Tyson:

The corporate’s dedication to realize net-zero greenhouse gasoline emissions by 2050

Advertising of its beef merchandise as “climate-smart”

The lawsuit argues that Tyson’s claims are unsubstantiated and deceptive to customers who’re more and more excited about buying climate-friendly meals. EWG contends that Tyson produces important volumes of climate-warming emissions at each stage of its industrial meat manufacturing course of. The environmental group claims that Tyson has no concrete plans to realize its said objectives and isn’t taking significant steps to take action.

The lawsuit alleges that regardless of Tyson’s annual revenues exceeding $53 billion, the corporate spends lower than $50 million (lower than 0.1% of its income) on greenhouse gasoline discount practices. EWG claims that Tyson spends about eight occasions extra on promoting than on analysis.

Tyson produces about 20% of U.S. beef, rooster, and pork. The corporate’s greenhouse gasoline emissions reportedly exceed these of total international locations like Austria or Greece. Beef manufacturing is alleged to be accountable for 85% of the corporate’s emissions.

The lawsuit was filed beneath the District of Columbia Client Safety Procedures Act (CPPA). EWG is being represented by a coalition of environmental and animal rights organizations. The lawsuit seeks injunctive aid, aiming to cease Tyson from persevering with to make these environmental claims and to carry the corporate accountable for alleged violations of the CPPA.

Upshot: This authorized motion is a part of a rising development of scrutiny over company environmental claims, sometimes called “greenwashing.”

Weekly USDA dairy report

CME GROUP CASH MARKETS (9/20) BUTTER: Grade AA closed at $2.9725. The weekly common for Grade AA is $3.0205 (-0.1305). CHEESE: Barrels closed at $2.5900 and 40# blocks at $2.2375. The weekly common for barrels is $2.5755 (+0.1895) and blocks $2.2670 (-0.0220). NONFAT DRY MILK: Grade A closed at $1.3800. The weekly common for Grade A is $1.3845 (-0.0075). DRY WHEY: Further grade dry whey closed at $0.5875. The weekly common for dry whey is $0.5910 (-0.0020).

BUTTER HIGHLIGHTS: Butter demand within the East is regular. Butter demand is selecting up within the Central area. For the West area, salted butter demand is regular, however unsalted butter demand varies from regular to lighter. Cream volumes are usually out there all through the nation. Nevertheless, cream volumes are comparatively tighter within the Northeast a part of the nation. Butter manufacturing varies from sturdy to regular within the West. Within the Central and East areas, butter producers convey manufacturing schedules are busier than anticipated. Butter producers recommend manufacturing paces are snug for anticipated This autumn calls for. Bulk butter overages vary from minus 5 cents to 10 cents above market, throughout all areas.

CHEESE HIGHLIGHTS: Contacts share blended cheese manufacturing all through the U.S. Cheesemakers within the East be aware restricted spot milk availability as Class I demand attracts upon milk volumes out there for cheese processing. Contacts be aware demand for a number of cheese varieties is regular to stronger. Within the Central area, contacts be aware plant upkeep and downtime have freed up some milk provides for processors. For the primary time in a number of weeks, spot milk costs have been reported under Class III, starting from $0.75 under to $3.50 above Class III. Cheesemakers within the area say manufacturing efforts are geared towards upcoming vacation calls for. Barrel inventories have grown sufficient to accommodate spot purchases. Within the West, cheese producers relay regular to stronger manufacturing, regardless of variable spot milk availability. Cheese inventories within the area are blended, with barrel inventories famous to be particularly tight. The CME closing value for barrels reached a document excessive of $2.5650 on Tuesday the seventeenth and inched even larger to $2.6225 on Wednesday the 18th.

FLUID MILK HIGHLIGHTS: Farm degree milk manufacturing varies throughout the US. Lighter manufacturing is being seen all through the Central U.S. and the Southeast the place farms are experiencing hotter temperatures which have affected cow consolation. Regular manufacturing ranges are being seen within the Northeast and Mid-Atlantic states, the place seasonally cooler temperatures have begun to maneuver in. Volumes within the West are assorted throughout the area. California is seeing weaker numbers. Farm degree milk output is regular in Arizona. Numbers are stronger in New Mexico, the Pacific Northwest and the mountain states. The value vary for spot milk has widened with a great deal of milk being reported at $0.75 beneath Class III as much as $3.50 over Class. Spot milk masses stay scarce, however stakeholders convey some masses may be discovered to fill wants. Class I demand is close to the seasonal peak all around the nation and is affecting milk volumes which may have gone to Lessons II, III and IV. Demand for milk in these Lessons are regular to strong. Cream is usually extra out there in all areas as a result of Class I spinoff. Cream demand is regular to lighter within the West whereas it barely stronger within the Central and East areas. Manufacturing of cream cheese is seeing an uptick in some areas. Demand for condensed skim is regular as availability continues to tighten. Cream multiples for all Lessons are 1.23-1.45 within the East; 1.20-1.34 within the Midwest; and 1.10-1.29 within the West.

DRY PRODUCTS HIGHLIGHTS: Dry dairy commodities stay in a usually bullish sample within the penultimate buying and selling week of the quarter. The truth is, costs for low/medium warmth nonfat dry milk (NDM,) dry buttermilk, dry whey and whey protein focus (WPC) 34% have been regular to larger all through the nation. NDM demand is brisk, however there are notes of buyer pushback at growing costs. Dry buttermilk buying and selling exercise picked up this week, as prospects are exhibiting extra curiosity in current weeks. Availability of dry whey is tight, as mild seasonal milk provides proceed to get pulled from Class III to Class I vegetation. Lactose costs have been regular. Availability of lactose varies from lower- to higher-mesh sizes, as the previous is famous as considerably out there. Whey protein focus 34% curiosity is firming. Dry complete milk costs moved larger on continued experiences of tight availability. Acid and rennet casein costs have been regular on restricted buying and selling exercise.

ORGANIC DAIRY HIGHLIGHTS: Federal Milk Market Order 1, in New England, experiences utilization of kinds of natural milk by pool vegetation. Throughout August 2024, natural complete milk utilization totaled 18.52 million kilos, up from 18.14 million kilos the earlier 12 months. The butterfat content material, 3.28 p.c, is unchanged from a 12 months in the past. The utilization of natural diminished fats milk, 15.55 million kilos, decreased from 15.61 million kilos a 12 months in the past. The butterfat content material, 1.50 p.c, is up from 1.40 p.c the earlier 12 months.

NATIONAL RETAIL REPORT: Typical dairy adverts elevated by 11 p.c, and natural dairy adverts decreased by 45 p.c this week. Whole standard cheese advert numbers elevated by 10 p.c this week. Typical 6-8 ounce packages of sliced, shredded and block cheese have weighted common marketed costs of $2.56, $2.60, and $2.55, respectively. Each the sliced and shredded model cheeses made appearances in adverts greater than twice as typically in comparison with the block model for the 6-8 ounce package deal dimension. All three kinds had value decreases for this package deal dimension. The shredded model had the largest lower, which was 10 cents.